Gha Holding Tokenomics

The $GHAHG Tokenomics model has been meticulously designed to support a robust and balanced ecosystem that fosters sustainable growth, investor trust, and community engagement.

This comprehensive structure aligns with Gha Holding’s strategic objectives across real estate, cryptocurrency exchange, payment processing, and venture capital initiatives.

Below, we present a detailed breakdown of the $GHAHG token allocation, vesting schedule, utility, and strategic goals.

-

Total Token Supply:

Fixed Supply: 1,000,000,000 $GHAHG

The total supply is capped at one billion tokens, ensuring controlled scarcity and supporting token stability and value retention over the long term.

The fixed supply model enables effective planning of allocations, rewards, and ecosystem expansion while enhancing investor confidence by avoiding inflationary practices.

-

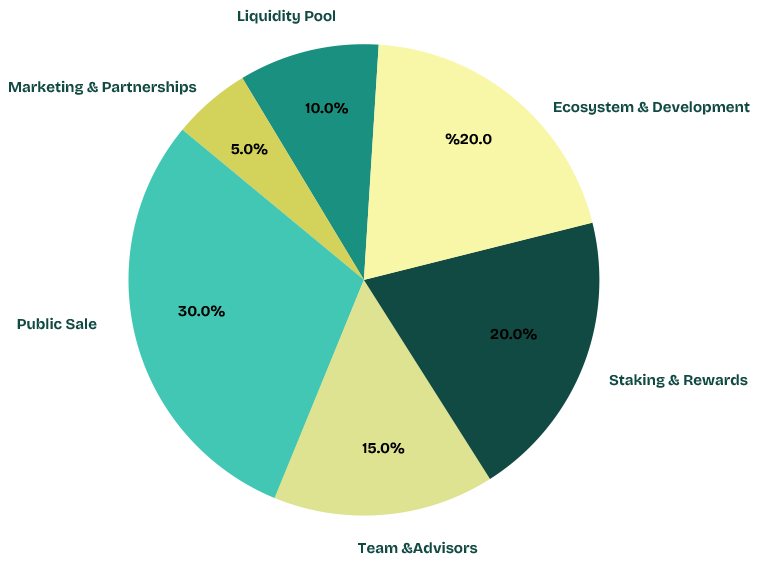

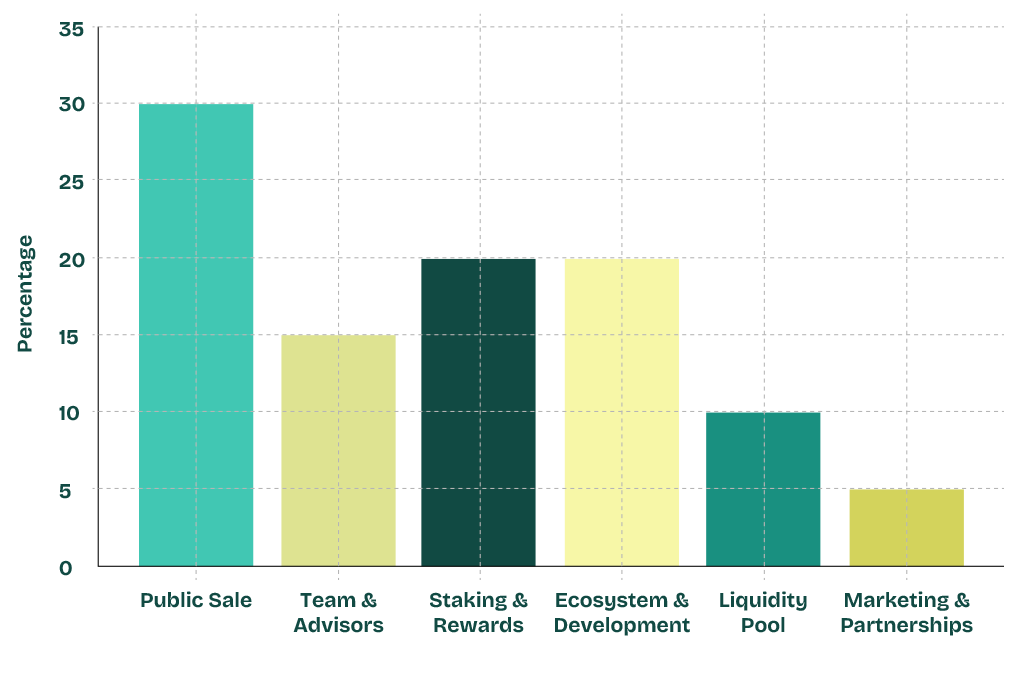

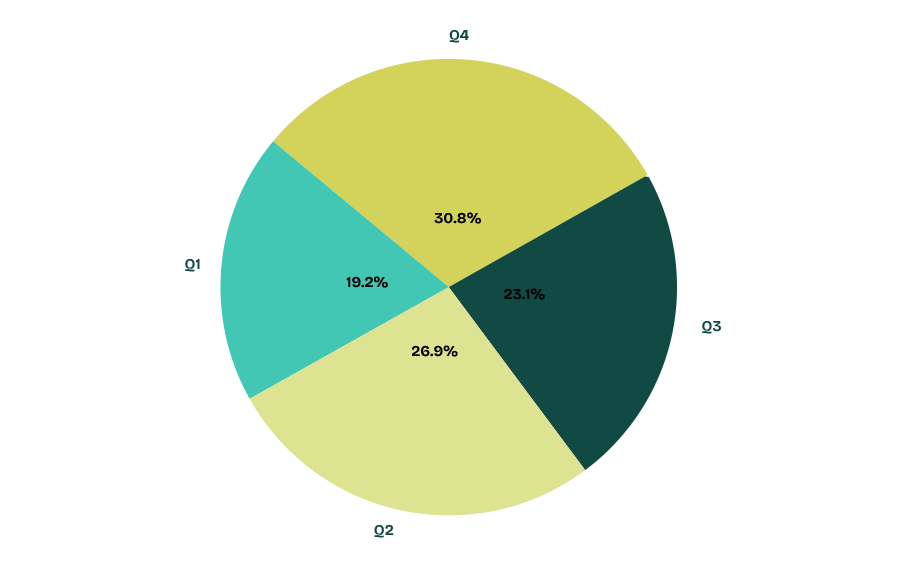

Token Allocation:

The token allocation is carefully structured to balance the immediate needs for growth, the long-term vision of Gha Holding, and the interests of investors and stakeholders.

This allocation plan ensures sufficient funding for development, liquidity for trading, and incentives for holders.

Breakdown of Allocation

01

Public Sale - 30% (300,000,000 $GHAHG)

Objective: Generate liquidity and market engagement by enabling a wide distribution among public investors.

Impact: Enhances token accessibility, creating a stable trading environment and volume across exchanges.

02

Team & Advisors - 15% (150,000,000 $GHAHG)

Objective: Retain top talent and incentivize advisors who contribute to the strategic vision and growth of Gha Holding.

Vesting Period: 1-year cliff followed by linear vesting over 3 years, ensuring long-term alignment with the company’s mission and market stability.

03

Staking & Rewards - 20% (200,000,000 $GHAHG)

Objective: Provide staking rewards and long-term incentives for token holders, encouraging loyalty and reducing market volatility.

Distribution: Gradual release over 5 years to maintain stable reward rates and prevent oversupply.

04

Ecosystem & Development - 20% (200,000,000 $GHAHG)

Objective: Support ongoing and future development projects, upgrades, and ecosystem expansion.

Vesting Period: 50% unlocked at launch; the remaining 50% released linearly over 2 years to ensure sustainable development funding.

05

Liquidity Pool - 10% (100,000,000 $GHAHG)

Objective: Provide liquidity for trading on centralized (CEX) and decentralized exchanges (DEX), ensuring reliable and stable market access.

Impact: Facilitates smoother trading experiences and minimizes price volatility.

06

Marketing & Partnerships - 5% (50,000,000 $GHAHG)

Objective: Drive brand growth, expand user engagement, and establish strategic partnerships.

Vesting Period: Released over 2 years with quarterly unlocks, allowing for sustained marketing and partnership activities.

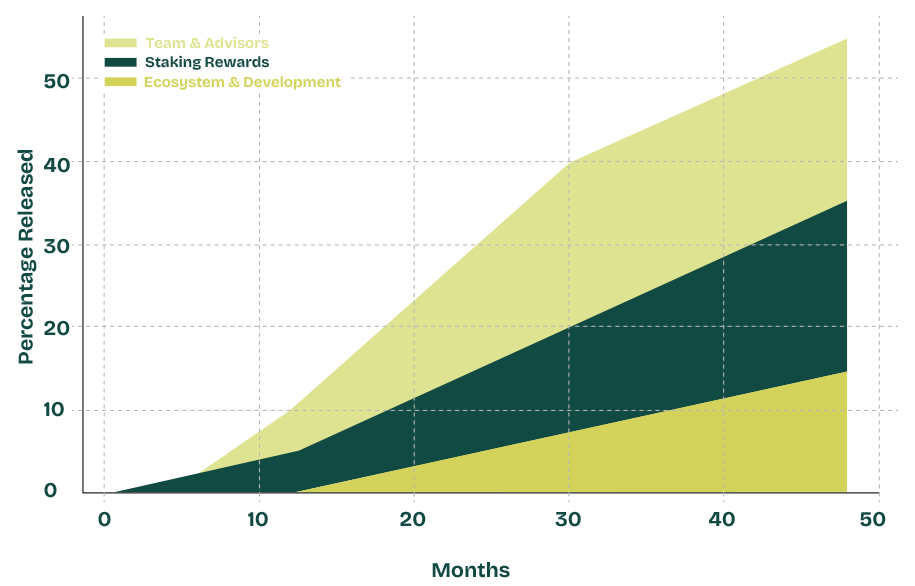

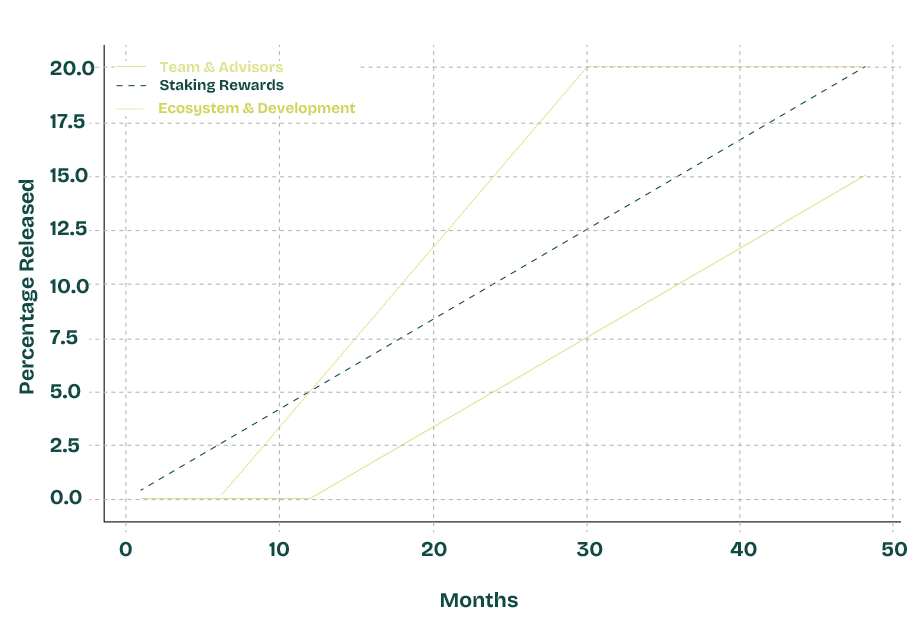

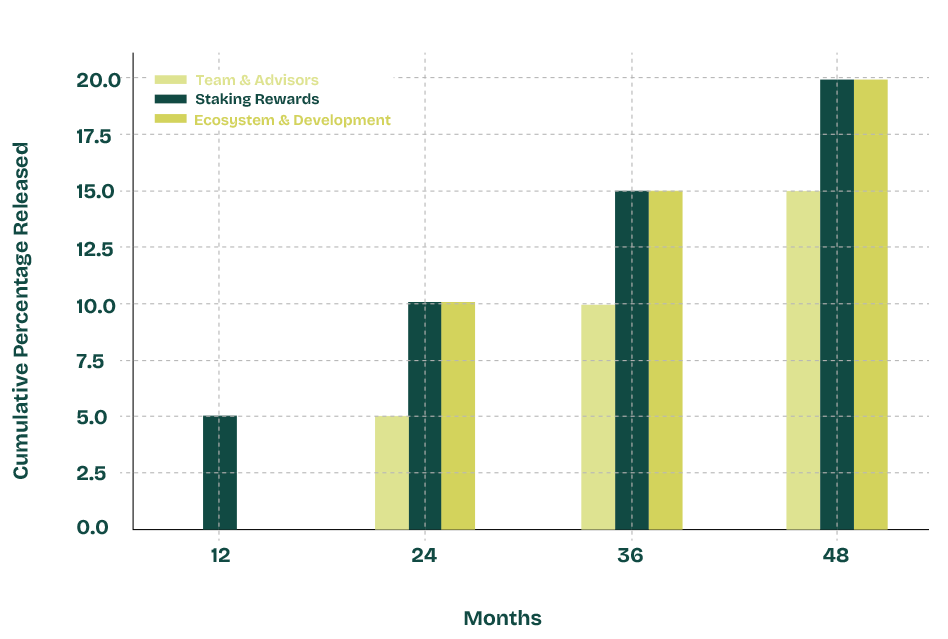

Vesting Schedule

The vesting schedule is designed to balance liquidity needs with the goal of ensuring a controlled release of tokens. This approach minimizes potential market disruptions while aligning stakeholder interests with the long-term vision of Gha Holding.

The cumulative vesting progression across Team & Advisors, Staking Rewards, and Ecosystem & Development, emphasizing the total token release over time.

Vesting Details:

-

Team & Advisors:

Cliff Period: 12 months.

Vesting Period: Linear release over 36 months post-cliff, ensuring that team and advisor incentives are tied to project milestones.

-

Staking & Rewards:

Release Timeline: Distributed over a 5-year period to maintain reward value and incentivize long-term holding.

-

Ecosystem & Development:

Initial Release: 50% available at launch.

Remaining Release: Gradual release over 24 months to secure ongoing funding for development needs.

-

Marketing & Partnerships:

Distribution Period: Quarterly releases over 2 years, maintaining a steady budget for marketing efforts and partnership building.

The gradual release of tokens across the three vesting categories over time, providing a clear view of the release schedule month-by-month.

The milestone-based cumulative percentages, offering a simplified view of vesting completion at specific intervals (e.g., 12, 24, 36, and 48 months).

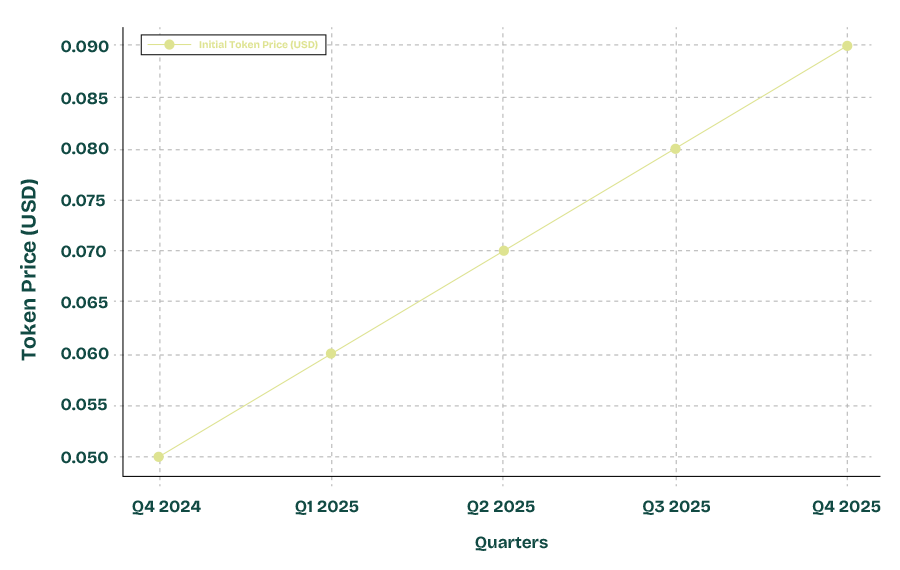

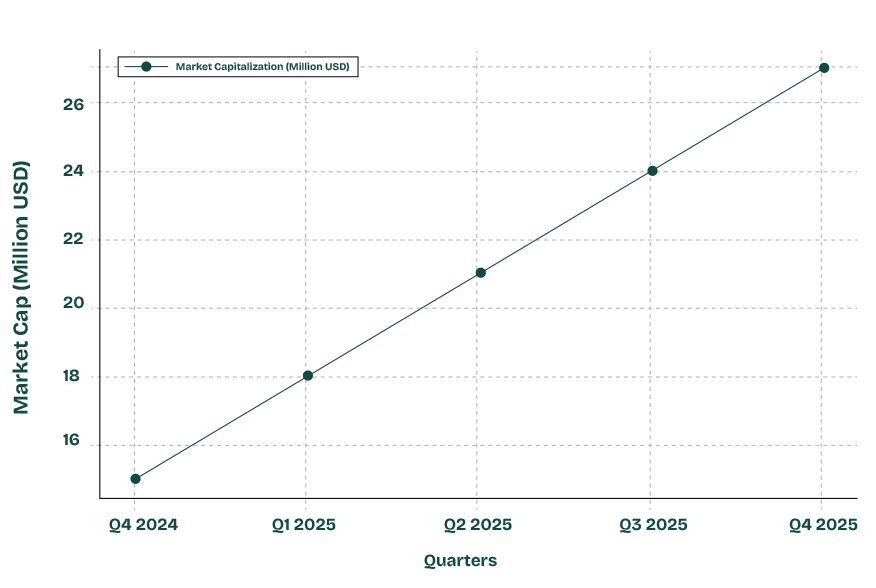

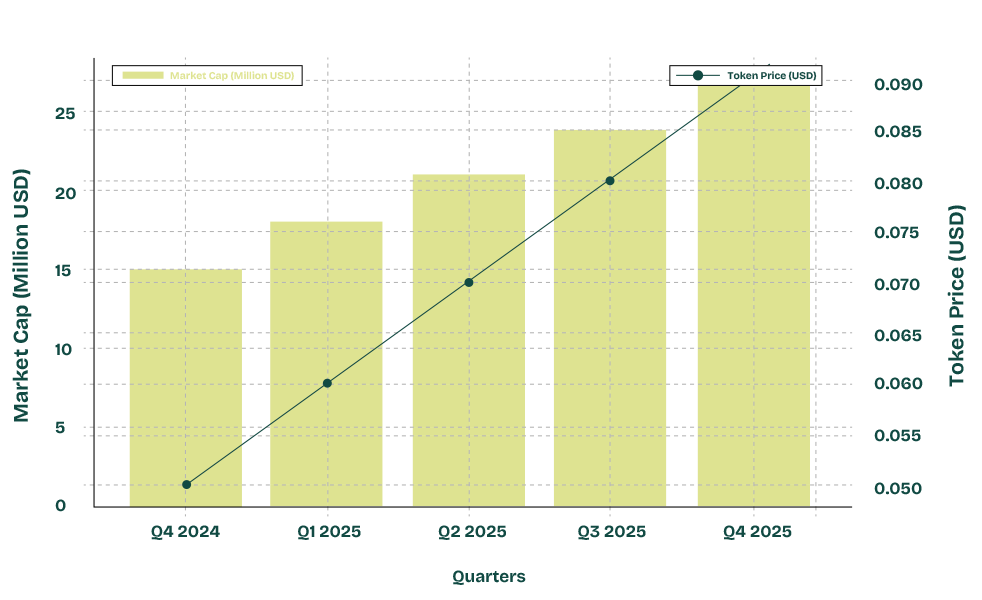

Initial Pricing & Market Capitalization

Token Price at Listing: $0.05 per $GHAHG

Initial Market Cap: Approximately $15 million, calculated based on the circulating supply at launch.

This initial pricing model is strategically chosen to ensure accessibility for a wide range of investors, while also reflecting the underlying value of Gha Holding’s diverse project portfolio and growth potential.

The projected growth in token price across quarters, allowing investors to visualize expected appreciation.

The anticipated market cap growth, reflecting the overall expansion of Gha Holding’s valuation.

The both market cap (bar) and token price (line), providing a comprehensive view of how price growth correlates with the expanding market cap.

Staking Model & Reward Structure

Gha Holding’s staking program is structured to provide competitive yields, reinforcing loyalty and encouraging long-term investment. Different staking tiers accommodate various investor levels, ensuring accessibility across the board.

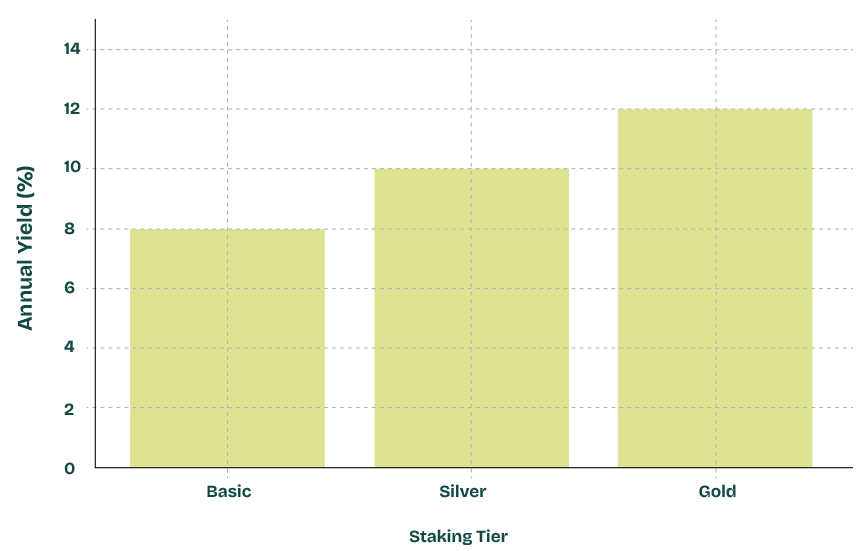

Staking Tiers & Annual Yield:

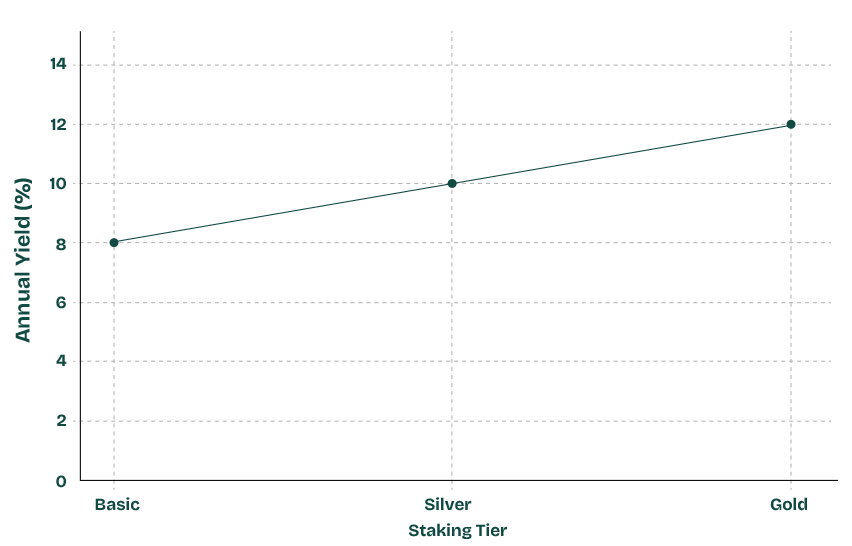

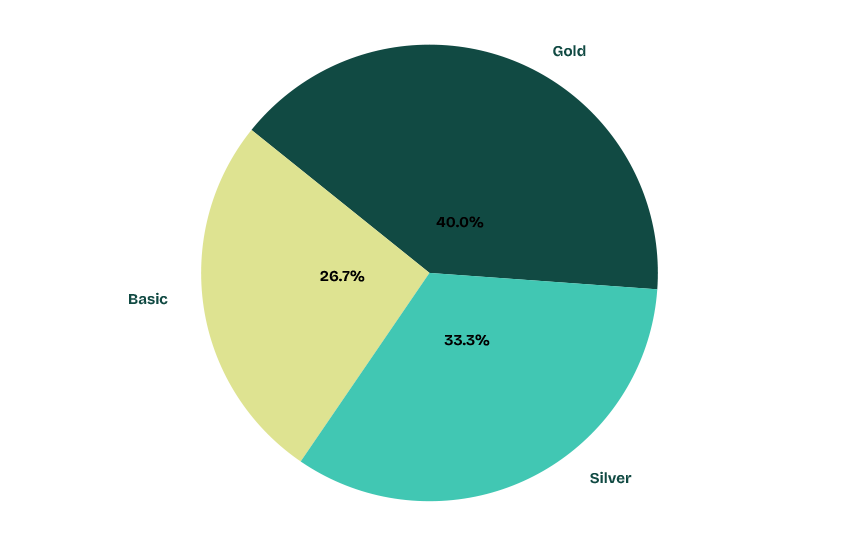

Basic Tier: Minimum 10,000 tokens, 8% APY.

Silver Tier: Minimum 50,000 tokens, 10% APY.

Gold Tier: Minimum 100,000 tokens, 12% APY.

Payout Frequency: Rewards are distributed quarterly, and compounding is available, incentivizing extended participation for higher returns.

Annual yield comparison for each staking tier, making it easy to see the yield progression across Basic, Silver, and Gold levels.

The visual trend of the yield increase across staking tiers, highlighting the incremental benefits as users move up in tiers.

The distribution of yield percentages across the tiers, emphasizing the proportional difference in rewards.

Utility & Governance

The $GHAHG token is designed as a versatile utility token that supports a wide range of use cases within the Gha Holding ecosystem. This enhances its intrinsic value and strengthens its appeal to investors.

Project Access: Token holders gain exclusive access to investment opportunities within Gha Property, particularly in Dubai’s real estate market, which offers both stability and growth potential.

Staking & Passive Income: Holders can earn staking rewards, providing a consistent source of passive income and incentivizing token retention.

Governance Rights: Major token holders may gain governance rights, allowing for active participation in strategic decisions, including future project expansions, partnerships, and ecosystem upgrades.

Burn Mechanism & Quarterly Buybacks

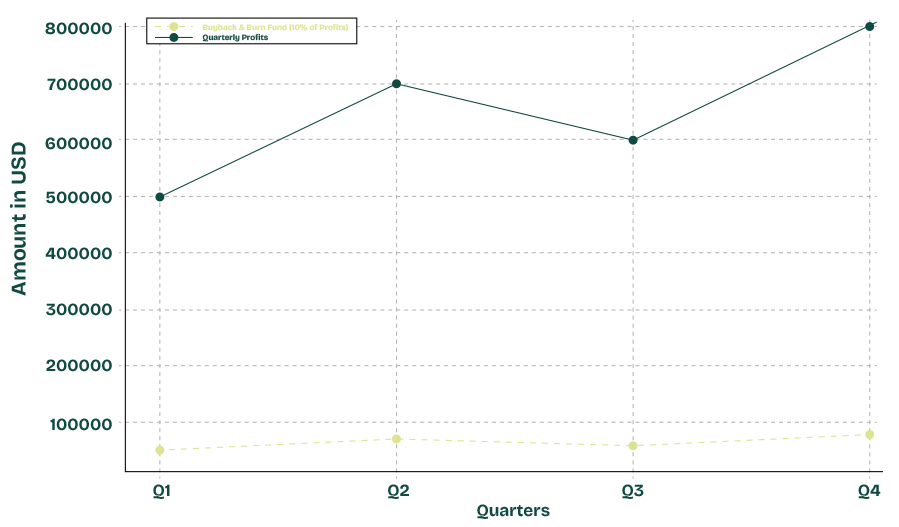

To further support the token’s value, Gha Holding will implement a buyback and burn strategy funded by project revenues:

Quarterly Buybacks: 10% of profits from Gha Property will be allocated to token buybacks.

Burn Mechanism: Tokens acquired through buybacks will be permanently removed from circulation, decreasing supply and potentially increasing token scarcity over time.

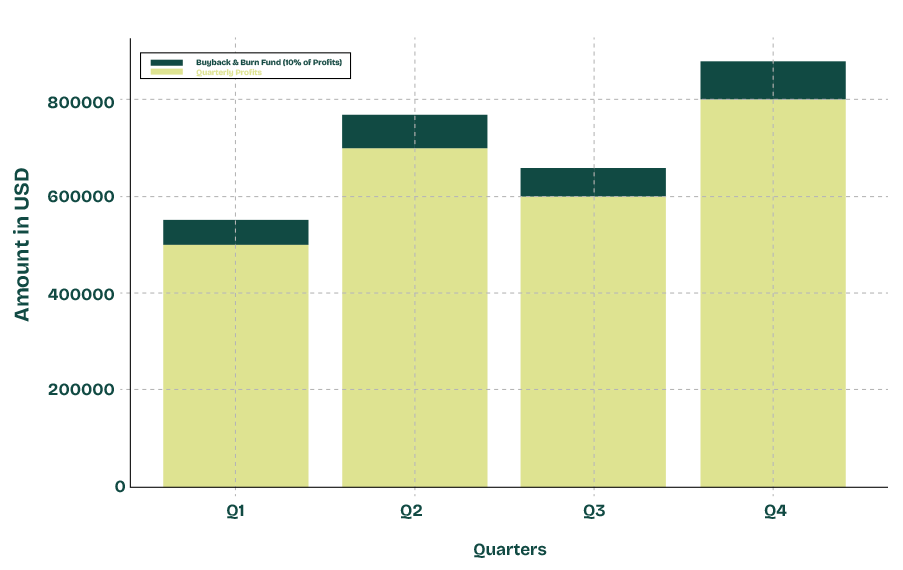

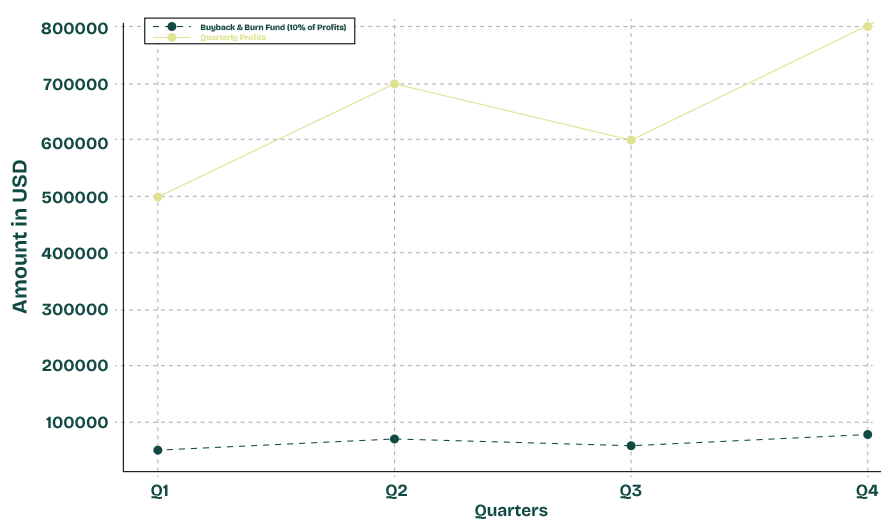

The quarterly profits and the allocation to the buyback and burn fund (10% of profits), allowing for a clear view of trends over time.

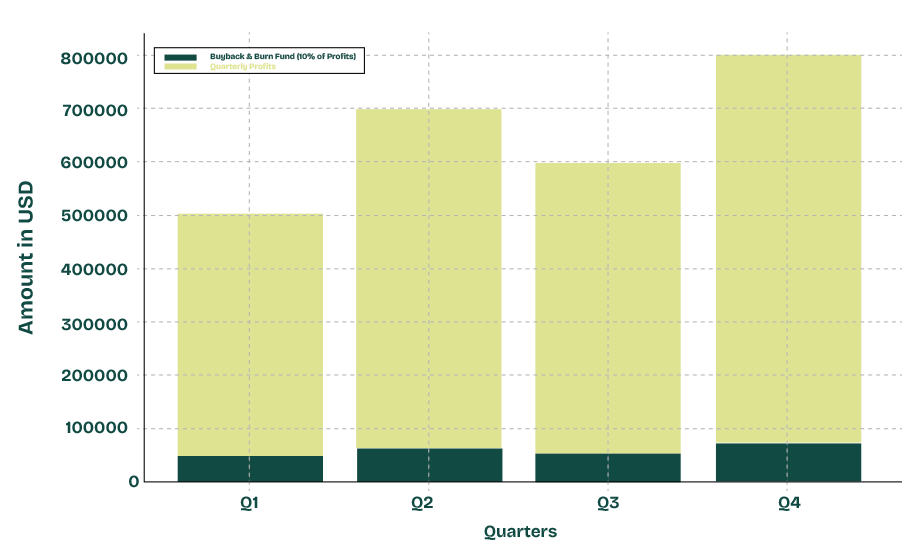

The both the total quarterly profits and the buyback allocation stacked on top, providing a visual representation of each quarter’s contribution to the buyback fund.

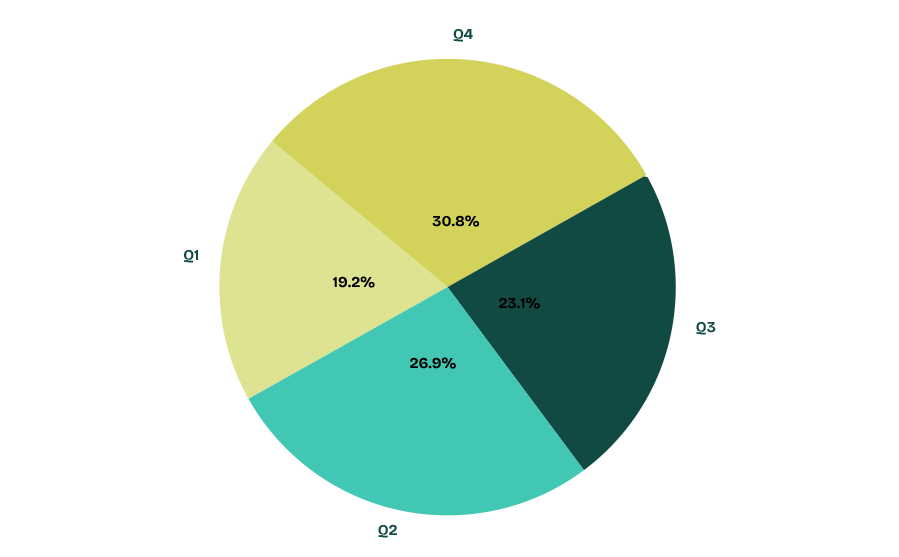

The buyback fund as a percentage of total profits across all quarters, highlighting the relative contribution from each quarter.

Transparency and Security

Gha Holding prioritizes transparency and regulatory compliance, aiming to build a sustainable and reliable ecosystem for investors.

Smart Contract Audits: All smart contracts are audited by top-tier firms, ensuring secure token functionality and safeguarding investor funds.

Transparent Reporting: Regular reports on token distribution, staking rewards, and project milestones are shared with the community.

Regulatory Compliance: Gha Holding complies with all relevant regulations in Dubai, reinforcing our commitment to integrity and trustworthiness.

The trend of quarterly profits and the corresponding 10% buyback fund over each quarter.

The profits with the buyback fund visually stacked on top, illustrating the contribution of the buyback to overall quarterly revenue.

Each quarter’s buyback fund as a percentage of the total profit across all quarters, highlighting the relative contribution of each quarter’s buyback allocation.

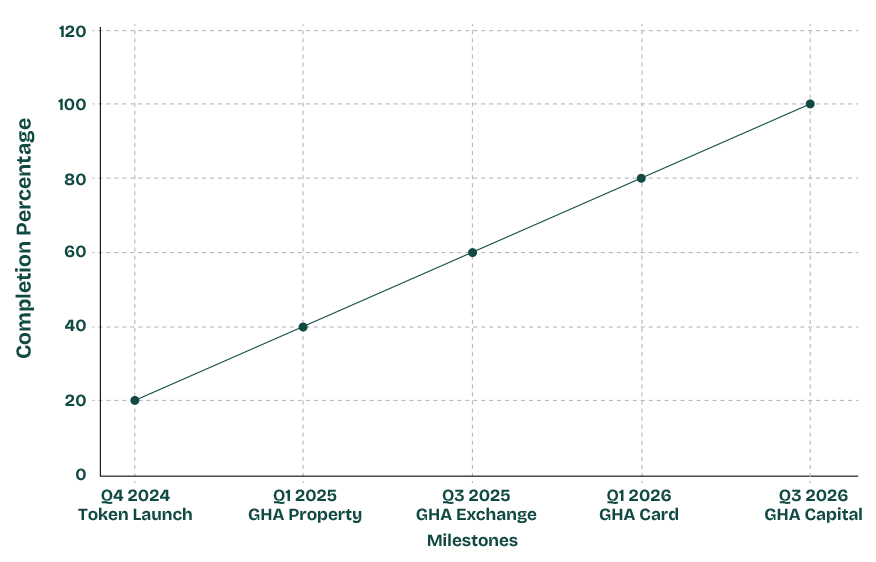

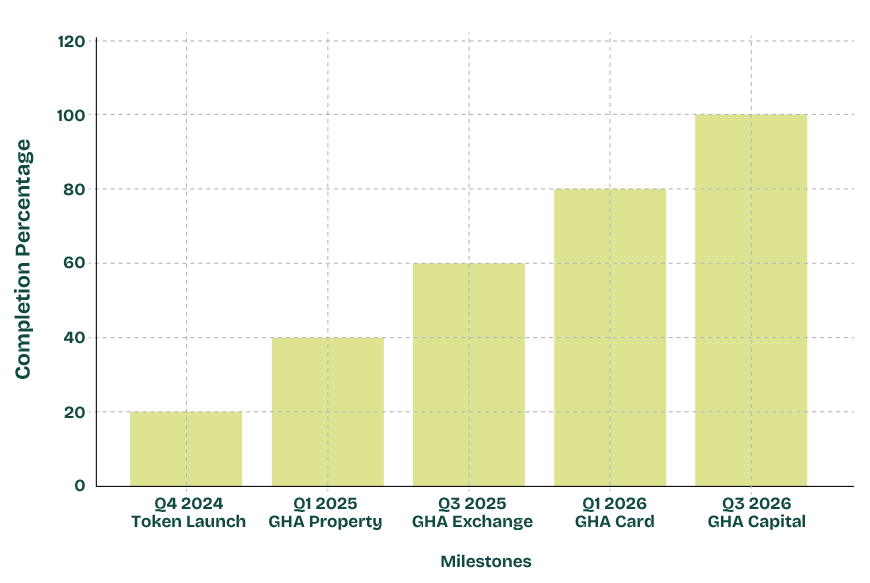

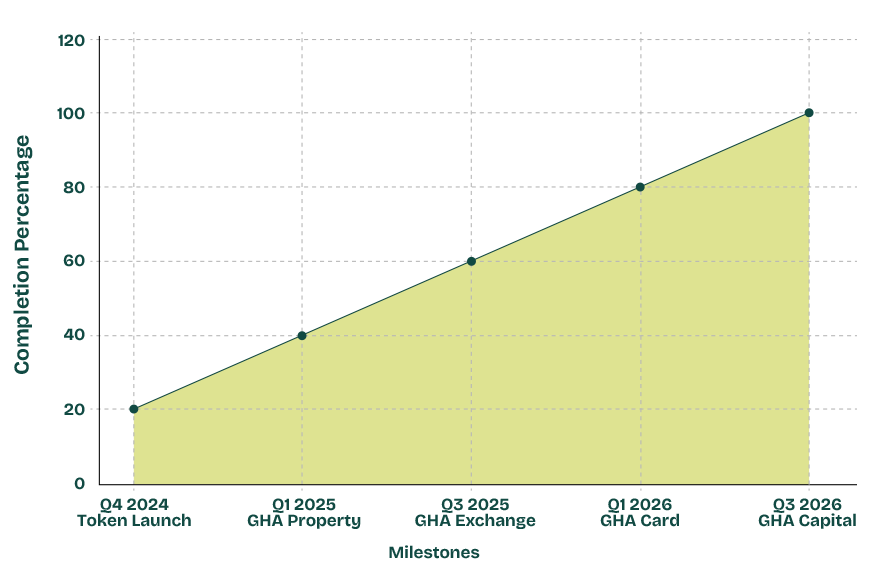

Project Roadmap and Strategic Milestones

Gha Holding has set a series of targeted milestones for each of its core projects. Each phase is aligned with the vesting and token release schedules to maximize value and growth potential for $GHAHG.

Q4 2024

Token launch and centralized exchange listing

Q1 2025

Launch of Gha Property’s real estate investment platform

Q3 2025

Gha Exchange goes live, supporting crypto asset trading

Q1 2026

Introduction of Gha Card, enabling crypto payments

Q3 2026

Launch of Gha Capital to support high-potential crypto projects

Gha Holding has set a series of targeted milestones for each of its core projects. Each phase is aligned with the vesting and token release schedules to maximize value and growth potential for $GHAHG.

The progression of project completion across key milestones, providing a clear view of each phase’s advancement.

Each milestone’s completion percentage, offering a straightforward comparison between different phases.

The cumulative completion over time, emphasizing the overall growth trajectory and project milestones.